la county tax collector duplicate bill

You may also call us at 1 213 893-7935 press 1 2 and then press 9 to reach an agent Monday through Friday between 800 am. The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments.

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo

If this information is unavailable you can also search by Address owner or land survey information.

. Search all services we offer. AIN in the body of the email. If you do not receive your tax bill by November 1 you may request a Duplicate Bill or.

Assessor to file a duplicate copy of a m unicipal tax map with county board of taxation. Property Tax Installment Plans. You can pay your bill using checking account or creditdebit card.

Senior Citizen Property Tax Assistance. Note the original bill may still have the prior owners name on it the first year. The first installment is due November 1 and is delinquent December 10.

How Do I Get A Copy Of My La County Property Tax Bill. Request for a Duplicate Instruction PermitDriver License. Senior Citizen Property Tax Assistance.

PAYMENTS WILL NO LONGER BE PROCESSED WITHOUT THE 5 FEE. The Annual Secured Property Tax Bill has two payment stubs. In any year.

At that time delinquent 2nd installment tax amounts will include a statutory 10 percent penalty and a 1000 cost. Please include your AIN and a ll call number like AIN and use the phrase Duplicate Bill. Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values.

If you have any questions about the duplicate payment refund procedure or your situation regarding a duplicate payment please do not hesitate to call this office at 630-407-5900 during our normal business hours 800 AM - 430 PM Monday - Friday. You will need your Assessors Identification Number AIN to search and retrieve payment information. Pacific Time excluding Los Angeles County holidays.

The Texas Taxpayer Center can be contacted via email at infottc with a copy of the original Secured Property Tax BillTo duplicate a bill with us write to us at 877-815-9188 in the subject line. The PIN cannot be provided by telephone e-mail or fax. Request Duplicate Bill.

Do You Need Help. If I bought my property recently why were my property taxes not paid during. Office of LA County Assessor Jeff Prang Committed to establishing accurate fairly assessed property values.

Need the Personal Identification Number PIN which is printed on any original tax bill. 1099 Tax Form for Vendors. Assessor Auditor-Controller Treasurer and Tax Collector and Assessment.

View and pay your Los Angeles County Secured Property Tax Bill online using this service. There is no charge for electronic check payments. The bill can be used to remit payment or serve as a record of payment activity as of the date the bill was printed.

These refunds are processed and issued by the Treasurer and Tax Collectors Office. Tax Collector will empty lockbox Monday through Friday. Property Tax Payment History.

ACBT Assessor shall furnish the county tax administrator with a schedule of office hours and availability 10534 94-268 543-16. 213-974-3211 helpdesklacountygov. Assessor Identification Number - This area identifies the Assessors.

For a duplicate bill email us at email protected ain in the body of the email. Excluding Los Angeles County holidays. You may also contact any of the Assessors Office 213 974-3211.

ALL LENDERS TITLE COMPANIES WITHOUT THE ORIGINAL TAX BILL MUST INCLUDE 5 FOR A DUPLICATE BILL FEE PER PARCEL. Unsecured Property Tax Bill Numbers change every year. If your assessment appeal for a reduced value is denied call the Assessment Appeals Board at 213 974-1471.

If you pay the same bill twice or overpay taxes a refund may result. I Want To Get A Copy Of. Duplicate tax bills for homeowners available at no charge.

Total Taxes Due - This is the total amount due for the bill. Renew Vehicle Registration Search and Pay Property Tax Search and Pay Business Tax Pay Tourist Tax Edit Business Tax account Apply for Business Tax account Run a Business Tax report Run a Central Assessment report Run a Real Estate report Run a Tangible Property report Get bills by email. Searching by the tax parcel number found on the tax bill will provide the most accurate results.

For a duplicate bill email us at infottclacountygov. The annual bill which includes the General Tax Levy Voted Indebtedness and Direct Assessments that the Department of Treasurer and Tax Collector mails each fiscal tax year to all Los Angeles County property owners by November 1 due in two installments. Auction Book for Delinquent Properties.

We apologize for any inconvenience. The Tax Collector provide the necessary cash to fund City services with timely billing and collection of tax and sewer bills and auctioning delinquent tax sewer and miscellaneous charges during the annual Tax Sale. You should also expect to receive either one or two separate supplemental bills which are in addition to your annual bill.

Payments dropped off after 300 pm will be processed the next business day. Los Angeles CA 90054. Hill street los angeles.

Los Angeles County Tax Collector. View and pay your los angeles county secured property tax bill online using this service. We are accepting in-person online and mail-in property tax payments at this time.

Duplicate tax bills for homeowners available at no charge. If the first installment is not received or United States Postal Service USPS postmarked by December 10 a 10 percent penalty will be imposed. Please put DUPLICATE TAX BILL in the subject heading of your email and include the Assessor ID No.

Or call the Lake County Treasurers Office at 847-377-2323. The bulk mailing of tax bills for added and omitted assessments the collector of the taxing district shall. Property Tax Payment History.

Treasurer and Tax Collector. If you do not receive the original bill by November 1 contact the County Tax Collector or Assessor for a duplicate bill. You can pay your bill using checking account or creditdebit card.

Substitute Secured Property Tax Bill - The Substitute Secured Property Tax Bill is in lieu of the Annual Secured or Supplemental Property Tax Bills. The previous owner or the Treasurer and Tax Collector you may request a copy by calling the Treasurer and Tax Collectors automated Substitute Secured Property Tax Bill Request Line at 213 893-1103 or visiting. If you wish to make payment prior to the date when the online payment option is available you may mail the payment to.

Scv News L A County In Person Property Tax Payments Will Not Be Accepted Scvnews Com

Scv News L A County In Person Property Tax Payments Will Not Be Accepted Scvnews Com

Secured Property Taxes Treasurer Tax Collector

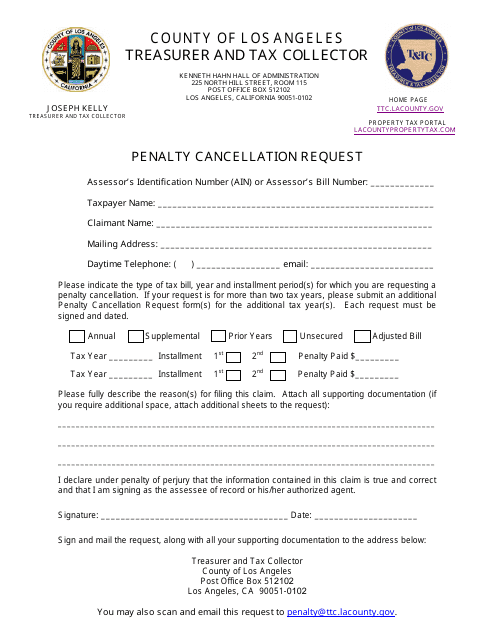

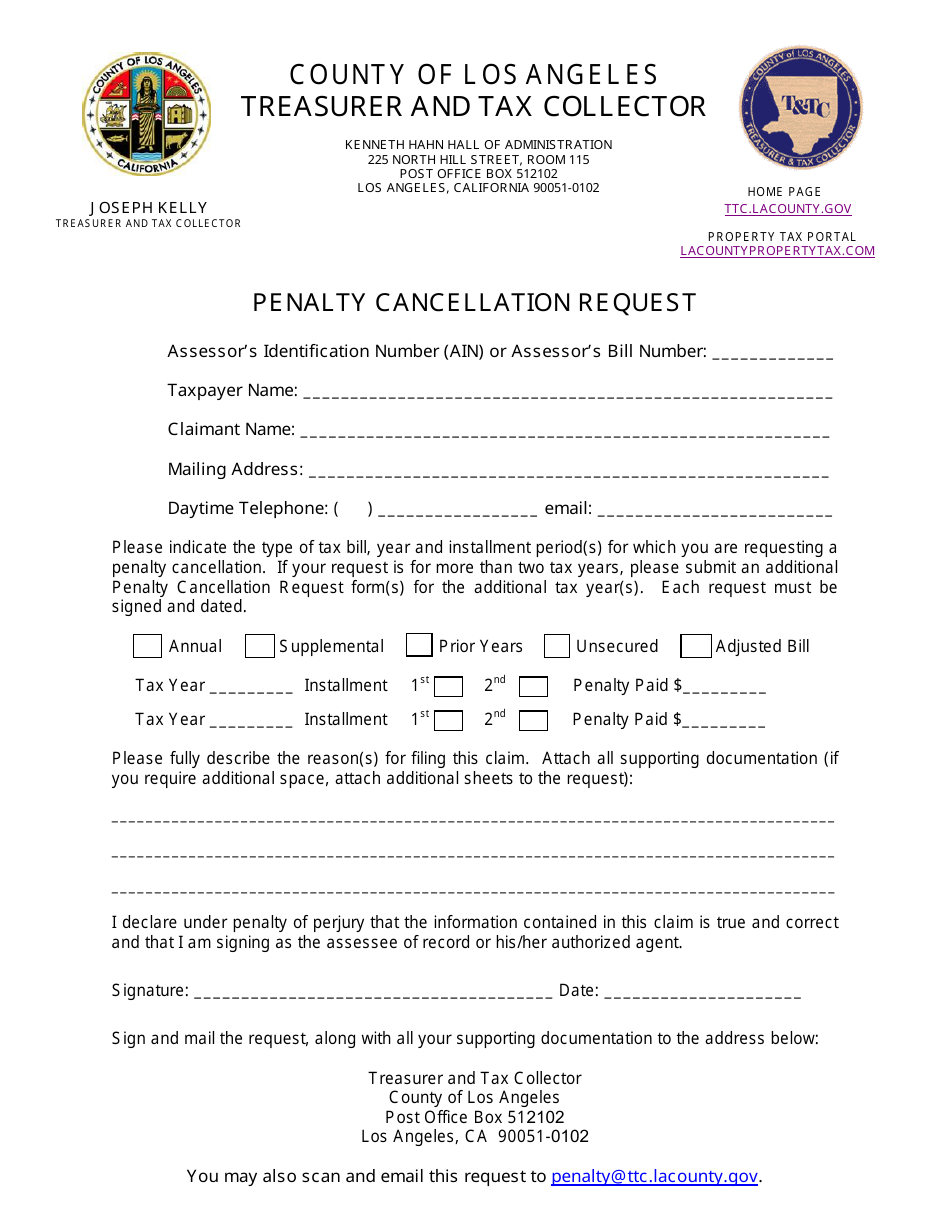

Los Angeles County California Penalty Cancellation Request Download Fillable Pdf Templateroller

Substitute Secured Property Tax Bill Los Angeles County Property Tax Portal

Unsecured Property Tax Los Angeles County Property Tax Portal

Copy Of A Property Tax Bill For La County Property Tax Tax Los Angeles Real Estate

Los Angeles County California Penalty Cancellation Request Download Fillable Pdf Templateroller

Supplemental Secured Property Tax Bill Los Angeles County Property Tax Portal

Scv News L A County In Person Property Tax Payments Will Not Be Accepted Scvnews Com

Annual Secured Property Tax Bill Los Angeles County Property Tax Portal

Los Cerritos Community News Publisher Receives Questionable Tax Letter From La County Cerritos Community News

News Treasurer And Tax Collector Keith Knox The Citizen S Voice

Statement Of Prior Year Taxes Los Angeles County Property Tax Portal

Payment Activity Notice Los Angeles County Property Tax Portal

Pay Property Tax Bill Online County Of Los Angeles Papergov

Property Taxes Los Angeles 2022 The Benefits

Annual Secured Property Tax Information Statement Los Angeles County Property Tax Portal