gambling income tax calculator

Like all forms of gambling winnings money you get from sports betting counts as income. This calculator computes only an estimate of the income tax on gambing winnings for individuals with fairly complex tax situations.

Tax Deductions 2017 50 Tax Write Offs You Don T Know About Tax Write Offs Tax Deductions Filing Taxes

This will itemize your gambling income.

. So you are finally a consistent winner at your local poker room casino or race track. The amount of losses you deduct cant be more than the amount of gambling income you reported on your return. Other Resources - Other information related to gambling taxes.

Currently Illinois has a flat tax rate of 495 for all residents. More than 5000 in winnings reduced by the wager or buy-in from a poker tournament. On your federal form you submit this as other income on Form 1040 Schedule 1.

Professional Gambler Tax Calculator - Estimate the tax impact of filing as a Professional or Recreational Gambler. The state passed a law that states that all winnings received after 2017 and that are more than 5000 have a 24 percent federal gambling tax rate. Any winnings subject to a federal income-tax withholding requirement.

The actual amount you will owe in tax liability will depend on your tax bracket and could be lower or higher. Ad Our Resources Can Help You Decide Between Taxable Vs. As for state taxes in Ohio you report gambling winnings on Form IT 1040 but only winnings accrued in Ohio.

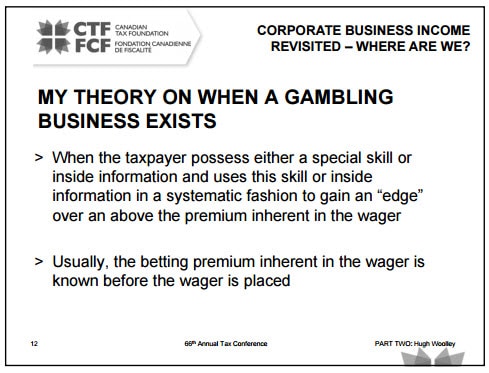

United States 292 F2d 630 631-632 5th Cir. Use our gambling winnings tax calculator to estimate your winnings after taxes. You must pay federal income taxes on all winnings regardless of amount and may owe state taxes as well.

Congratulations - you are in the minority. This includes cash and the fair market value of any item you win. The state tax rate in Michigan is 425 which is the rate your gambling winnings are taxed.

In designing this calculator I wanted it to be as easy to use as entering a single number yet insightful with suggestions from experts on how we can best. The following answers general questions on how gambling winnings are taxed in PA. For example if you win 620 from a horse race but it cost you 20 to bet your taxable winnings are 620 not 600 after subtracting your 20 wager.

You will pay gambling tax as you file income taxes. It ranks right up there with filing taxes car repairs and watching as someone painfully reads every word written on a slideshow. If youre unsure about a specific tax issue its best to consult a tax professional before filing to avoid any potential mistakes.

Whether theyre winnings from a slot machine horse track poker table or sportsbook they all count as income and are subject to state taxes. Cash is not the. By law gambling winners must report all of their winnings on their federal income tax returns.

Players should report winnings that are below 5000 and state their sources. When gambling winnings are combined with your annual income it could move you into a higher tax bracket so its important to be aware of. If youre a full-time Illinois resident you should report your gambling winnings on Form IL-1040.

The operator will use a gambling winnings calculator to determine the amount of tax you will pay after winning a big jackpot. For non-resident aliens the current withholding tax is 30 federal and 6 state. Its determined that gambling losses are a miscellaneous deduction.

Ad Find Deals on turbo tax online in Software on Amazon. 20 Deposit Bonus Up To 1000 Read Expert Review Bet Now. The second rule is that you cant subtract the cost of gambling from your winnings.

Its possible that gambling winnings when added to annual income could vault some players into a higher tax bracket. Illinois attempted to pass a graduated income tax amendment but voters denied it in November 2020. Whether you play on PA online gambling sites or at a land-based casino gambling winnings must be reported on your federal and PA income tax returns.

This calculator is not appropriate for individuals who are aged 65 years or more have dividend or capital gains income rental property income self-employment income farming income who receive Social Security benefits or. Just like other gambling winnings lottery prizes are taxable income. If you didnt give the payer your tax ID number the withholding rate is also 24.

Maryland levies between 2 and 575 in state taxes including gambling winnings. Jacksons Retirement Calculator Tool Helps Identify Gaps In Your Projected Monthly Income. Under the US Tax Code all income for US citizens is taxable whether earned in the US overseas or on the Internet.

Horse races dog races and jai alai if the winnings are at least 300 times the amount wagered. The tax rate paid by New York residents is dependent on their annual income and tax bracket. We provide Immediate IRS Help to Stop Wage Garnishment and End Your Tax Problems.

If your winnings are reported on a Form W-2G federal taxes are withheld at a flat rate of 24. 31 2019 taxes on gambling income in Illinois are owed regardless of what state you live in. In addition you submit any Ohio state tax withholdings on gambling winnings on this same form.

Effective rate is the actual percentage you pay after deductions. Enter the Simple Responsible Gambling Calculator. For example if you hit the trifecta on Derby Day you must report the winnings as income.

Claim your gambling losses up to the amount of winnings as Other Itemized. Taxable Gambling Income. These prizes arent subjected to the 2 Limit by being listed in the Schedule A Taxation.

This calculator is best for individuals who have dividend or capital gains income rental property income self-employment income farming income who receive Social Security benefits or have made contributions to a traditional IRA. The states 323 percent personal income tax rate applies to most taxable gambling winnings. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

Ad Use our tax forgiveness calculator to estimate potential relief available. Other transactions if the winnings are at least 300 times the amount wagered. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and Taxes with details on state and local sales income property and automobile taxes - Includes the cost of Child Care for toddlers or infants at a day.

For cash gambling winnings the payer must withhold 24 if your winnings minus your wager are 5000 or more and are from one of the following. This calculator computes only an estimate of the income tax on gambing winnings for individuals with fairly straightforward tax situations. The rules of state taxes are highly jurisdiction-specific however so be sure to research the specific laws of your own state.

Gambling income is almost always taxable income which is reported on your tax return as Other Income on Schedule 1 - eFileIT. Marginal tax rate is your income tax bracket. Even if no tax was withheld and you did not receive a W-2G form it is still your responsibility to report all gambling income on your federal and state tax returns according to the IRS.

You may deduct gambling losses only if you itemize your deductions on Schedule A Form 1040 and kept a record of your winnings and losses. In Arizona the Lottery is required by law to withhold 24 for federal taxes and 48 for state income taxes for United States citizens or resident aliens. Discover Helpful Information And Resources On Taxes From AARP.

For example if players win 150000 but lose 50000 in bets the taxable income allowed as a miscellaneous deduction is 100000 for that specific playthrough. Our Premium Calculator Includes. Section 61 a defines gross income as all income from whatever source derived including gambling unless otherwise provided.

Yes gambling winnings fall under personal income taxed at the flat Illinois rate of 495. Here is a breakdown of how the Maryland state tax structure works for someone filing single. The taxes on winning calculator shows the state tax that Colorado charges on winnings of up to 50 free spins in certain games and it is remitted two days after qualifying.

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Foreign Tax Credits Of The Income Tax Toronto Tax Lawyer

Income Tax With Notebook And Glasses Sponsored Sponsored Ad Income Notebook Glasses Tax Refinance Mortgage Mortgage Savings Mortgage Marketing

Taxes On Lottery Winnings Calculator Online 50 Off Www Ingeniovirtual Com

Council Post When Does It Make Sense For Business Owners To Hire A Tax Accountant Emeklilik Yangin Marmaris

Income Tax Calculator 2021 2022 Estimate Return Refund

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

:max_bytes(150000):strip_icc()/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

Go After Top Income Earners With A New Tax Bracket Opposition Urges P E I Government Cbc News

Are Sports Gambling Winnings Taxable In Canada Sportsbookbonus Ca

/w2g-4f92cd5df07f4003b9adb0cde2c3f6b6.jpg)

Form W 2g Certain Gambling Winnings Definition

5 Things To Know About Taxation Of Gambling Income Scholarly Open Access 2022

Gambling Taxes How Does It Work And How Much Does It Cost

Free Gambling Winnings Tax Calculator All 50 Us States

Gambling Winnings Tax H R Block

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Irs Money Template